- Home

- Personal Finance

- Insurance

- Health Insurance

With this model, you pay a membership fee for more personalized medical services.

By

Ella Vincent

published

16 January 2026

in Features

By

Ella Vincent

published

16 January 2026

in Features

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

Share Share by:- Copy link

- X

If you'd like to have a stronger relationship with your primary care doctor — and quick access to them when you want to chat or schedule an appointment — direct primary care may be worth a look. With a DPC arrangement, you pay a membership fee, and in exchange you get unlimited access to certain primary care services, such as disease screenings, chronic-condition management and laboratory tests. DPC practices don't accept health insurance, and you pay the membership fee out of pocket.

Compared with a traditional primary care office, which may manage thousands of patients, a DPC practice sees an average of 413 patients, according to the American Academy of Family Physicians (AAFP). With a smaller load, DPC doctors can usually offer same-day or next-day appointments and spend more time with patients.

Teresa Lovins, a primary care physician and owner of Lovin My Health DPC in Columbus, Ind., says that she sees patients for an average of an hour, allowing her to discuss their medical concerns in depth. The average primary care appointment lasts about half an hour, according to a 2024 study from the Journal of the American Medical Association.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

CLICK FOR FREE ISSUE

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Sign upDirect primary care is similar to concierge care, another membership-based model for primary care. Both involve a relatively small group of patients and focus on personalized services. But concierge memberships often cost more, with the annual tab ranging from $2,000 to $10,000, depending on the services you sign up for, according to consumer website ValuePenguin.

That compares with a typical annual cost of $600 to $1,200 for direct primary care, according to the AAFP. Concierge practices usually offer more in-depth physical exams and screenings. And concierge care doctors may bill your health insurance company for certain services.

Although the number of DPC practices has risen to more than 2,700 across the U.S., according to advocacy group DPC Frontier, they’re not available in all areas. You can see whether any DPC practices are near you with online directories, including mapper.dpcfrontier.com and dpcalliance.org/find-a-dpc-physician.

Covering the costs

Your DPC membership fee includes the cost of most preventive and primary care services. But you'll need to have health insurance to get coverage for emergency room visits, care from specialists, surgical procedures and other services your primary doctor does not provide, says Moti Gamburd, chief executive officer of home health care agency CARE Homecare, in Los Angeles.

One option is to use a high-deductible health plan, which offers lower premiums and a larger deductible than a typical policy. If your high-deductible plan is paired with a health savings account, you can set aside pretax money (up to $4,400 for self-only coverage in 2026, or $8,750 for family coverage) in the HSA and use it tax-free for qualifying medical expenses.

Good news on the HSA front for DPC patients: Beginning January 1, 2026, direct primary care membership fees are a qualified medical expense for tax-free HSA withdrawals, thanks to provisions in the One Big Beautiful Bill Act. HSA funds may cover up to $150 monthly for individuals, or $300 monthly for a family membership.

Additionally, the law clarifies that enrolling in a direct primary care arrangement does not disqualify someone from being able to contribute to a health savings account if they also have an eligible high-deductible health policy.

Previously, DPC patients who had a high-deductible policy could be barred from contributing to an HSA.

Note: This item first appeared in Kiplinger Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related Content

- What You Will Pay for Medicare in 2026

- 9 Types of Insurance You Don't Need

- The 7-Month Deadline That Sets Your Lifetime Medicare Premiums

Ella VincentSocial Links NavigationStaff Writer

Ella VincentSocial Links NavigationStaff WriterElla Vincent is a personal finance writer who has written about credit, retirement, and employment issues. She has previously written for Motley Fool and Yahoo Finance. She enjoys going to concerts in her native Chicago and watching basketball.

Latest You might also like View More \25b8

Smart Ways to Share a Credit Card

Smart Ways to Share a Credit Card

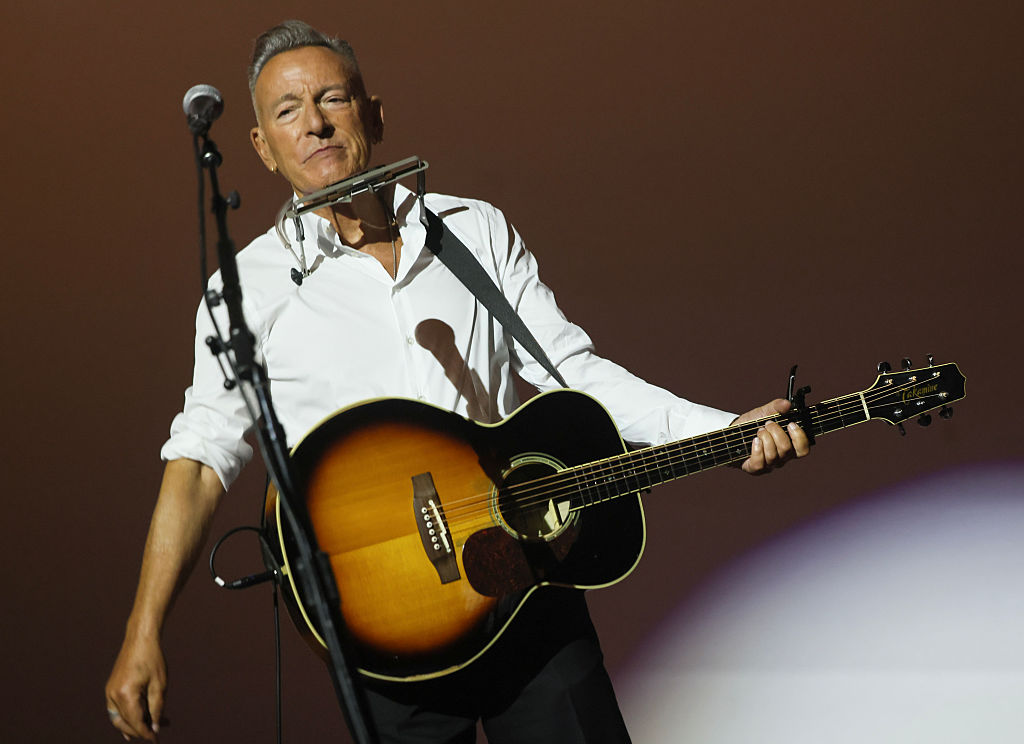

5 Bruce Springsteen Quotes Every Retiree Should Live By

5 Bruce Springsteen Quotes Every Retiree Should Live By

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second Term

Consider These 4 Tweaks to Your 2026 Financial Plan, Courtesy of a Financial Planner

Consider These 4 Tweaks to Your 2026 Financial Plan, Courtesy of a Financial Planner

We Know You Hate Your Insurance, But Here's Why You Should Show It Some Love

We Know You Hate Your Insurance, But Here's Why You Should Show It Some Love

6 Financially Savvy Power Moves for Women in 2026 (Prepare to Be in Charge!)

6 Financially Savvy Power Moves for Women in 2026 (Prepare to Be in Charge!)

Countries That Will Pay You to Move: Cash Grants, Incentives and What to Know

Countries That Will Pay You to Move: Cash Grants, Incentives and What to Know

Mortgage Protection Insurance: What It Covers and When It Makes Sense

Mortgage Protection Insurance: What It Covers and When It Makes Sense

How to Use Your Health Savings Account in Retirement

How to Use Your Health Savings Account in Retirement

Forget Job Interviews: Employers Will Find the Best Person for the Job in an Escape Room (This Former CEO Explains Why)

Forget Job Interviews: Employers Will Find the Best Person for the Job in an Escape Room (This Former CEO Explains Why)