Quiz: Are You Ready for the 2026 401(k) Catch-Up Shakeup?

If you are 50 or older and a high earner, these new catch-up rules fundamentally change how your "extra" retirement savings are taxed and reported.

Lifestyle sharing

If you are 50 or older and a high earner, these new catch-up rules fundamentally change how your "extra" retirement savings are taxed and reported.

Way before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.

Deciding when to claim Social Security is a complex, high-stakes decision that shouldn't be based on fear or simple break-even math.

This legendary songwriter’s lyrics provide the perfect roadmap for finding passion and purpose in retirement.

Embrace smaller, luxury ships for exceptional service, dining and amenities. You'll be glad you left the teeming hordes behind.

"Making $1 million was never a goal, but maybe it should have been. I simply wanted to be debt-free and never worry about money."

Here's how to reduce your tax bill when you withdraw money in retirement.

Whether you are still working or planning to retire this year, understanding the 2026 late penalties for Parts A, B and D is essential for your financial health.

Here's a look at how Warsh could influence future Fed policy if he's confirmed.

I want to travel while we are still healthy, but my wife wants to pass down our wealth. Who is right?

As mortgage rates stabilize and fewer owners hold ultra-low loans, the lock-in effect may be losing its grip.

While the overall divorce rate has seen a small but steady decline, gray divorces have been on the rise since the 1990s.

Poor investment returns early in retirement on top of withdrawals can quickly drain your savings. The ideal plan helps prevent having to sell assets at a loss.

The ideal car insurance deductible balances risk and savings. Here's how to find it.

A little oversight or automation can keep money in your pocket.

Gen X and Millennials are expected to receive trillions of dollars in inheritance. Unless it's managed properly, the money could slip through their fingers.

Retirement rarely follows the script. That’s why the best retirees learn to improvise.

Money is freedom in retirement; here’s how to earn more of it with a profitable side gig

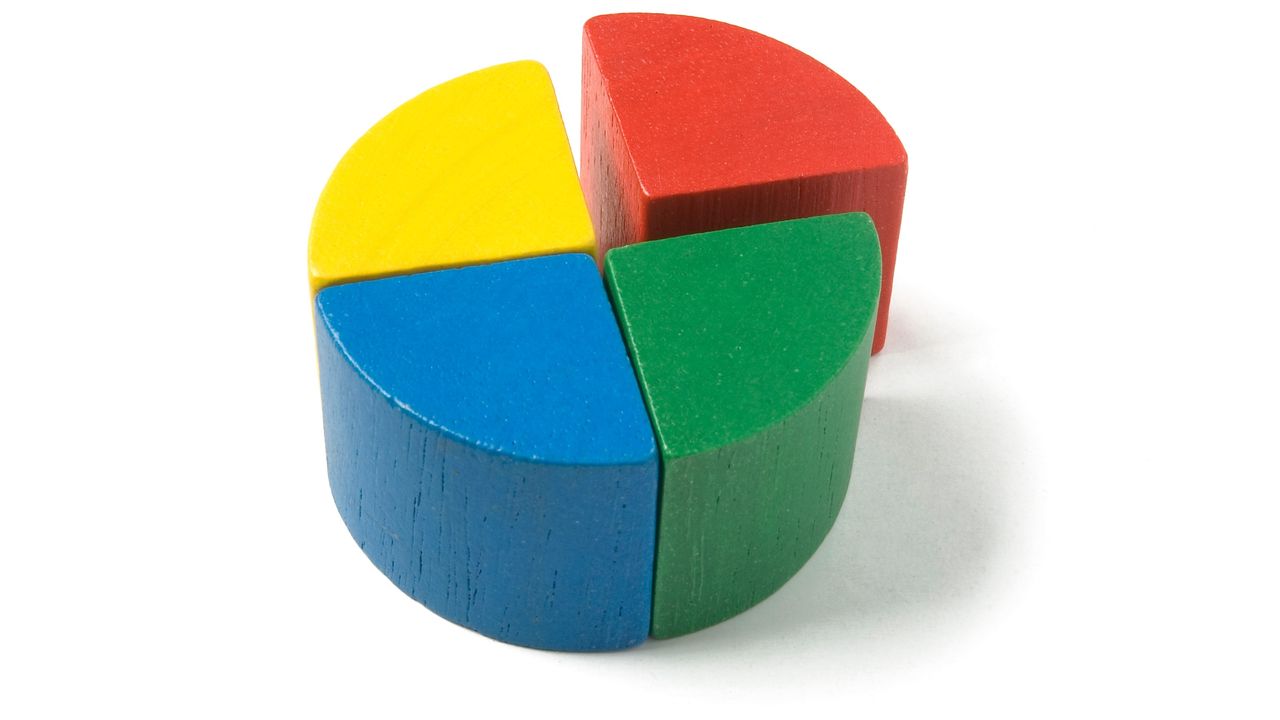

Overwhelmed by your financial to-do list? Split it into four quarters and assign each one goals that connect to the time of year. It could be life-changing.

We asked real estate and psychotherapist professionals for advice.