Congress Set for Busy Winter

The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

Entertainment gossip news

The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

What do you do if your biggest financial threat is simply having too much of a good thing — money?

For financial success in 2026, look beyond the numbers to identify the people who influence your decisions, then set them realistic expectations

If you're feeling shaky about your finances as you approach retirement, here are four tasks to complete that will help you focus and steady your nerves.

The OBBBA's permanent lower tax rates removed the urgency for Roth conversions. Retirees thinking of stopping or blindly continuing them should do this instead.

Five stats show how you need to rethink retirement, because "the future ain’t what it used to be."

Who you list on your policy matters more than most drivers realize, especially when it comes to who lives in your home.

What shoppers need to know about eligibility, bill credits and plan costs.

Sure, it's pricey, the policies are confusing, and the claims process is slow, but insurance is essentially the friend who shows up during life's worst moments.

There's never a bad time to make or review a financial plan. But recent changes to the financial landscape might make it especially important to do so now.

Why head south for the winter and pay for two properties when you can have a better lifestyle year-round in a less expensive state?

Income from your pension, savings and Social Security could provide the protection bonds usually offer, freeing you up for a more growth-oriented allocation.

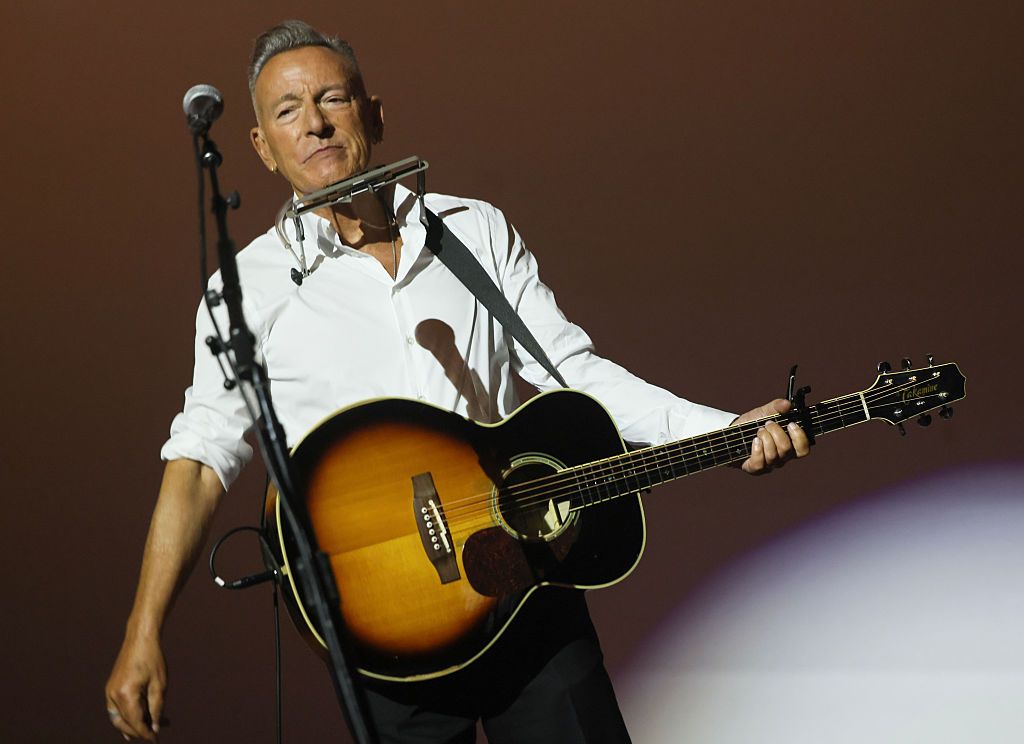

The 'Boss' of rock-and-roll has a lot to say about living and getting old gracefully.

Adding an authorized user has its benefits, but make sure you set the ground rules.

With the direct primary care model, you pay a membership fee for more personalized medical services.

In this week's Ask the Editor Q&A, Joy Taylor answers questions on preparing and filing your 2025 Form 1040.

For 40 years, private equity enjoyed extraordinary returns thanks to falling rates and abundant credit. That's changed. What should PE firms and clients do now?

Don't let the day-to-day get in the way of long-term financial planning. Here's how to get organized — including a reminder to dream big about your future.

Millions of people over 65 care for grandkids, adult kids or aging parents and will also need care themselves. Building a caregiving strategy is crucial.

We asked Certified Divorce Financial Analysts for advice.